For High Net-Worth Individuals

Typical client profile: Age 29 to 65; Net Worth $5MN or greater; Business-Owner, Entrepreneur, Professional; Desire to retain capital while maximizing wealth transfer without estate tax & also benefiting from tax-free retirement.

Introduction to Premium Financing

Most believe the wealthy make the risky investments, to achieve their wealth.

Do you know many wealthy families have been investing money into life insurance policies that have cash accumulation features.

We can help you in the faster accumulation of your wealth by deploying the concept of premium financing. What is premium financing?

Premium financing is essentially a loan that an individual or a business takes out to purchase an insurance policy, such as life insurance or a retirement policy. The loan is secured against the cash surrender value of the acquired insurance policy. Many third-party lenders offer insurance premium financing, including many private banks and finance companies.When a business receives funds to pay an insurance premium, the borrower is required to pay, on an annual basis, the interest on the loan.

The Process and How We can Help You

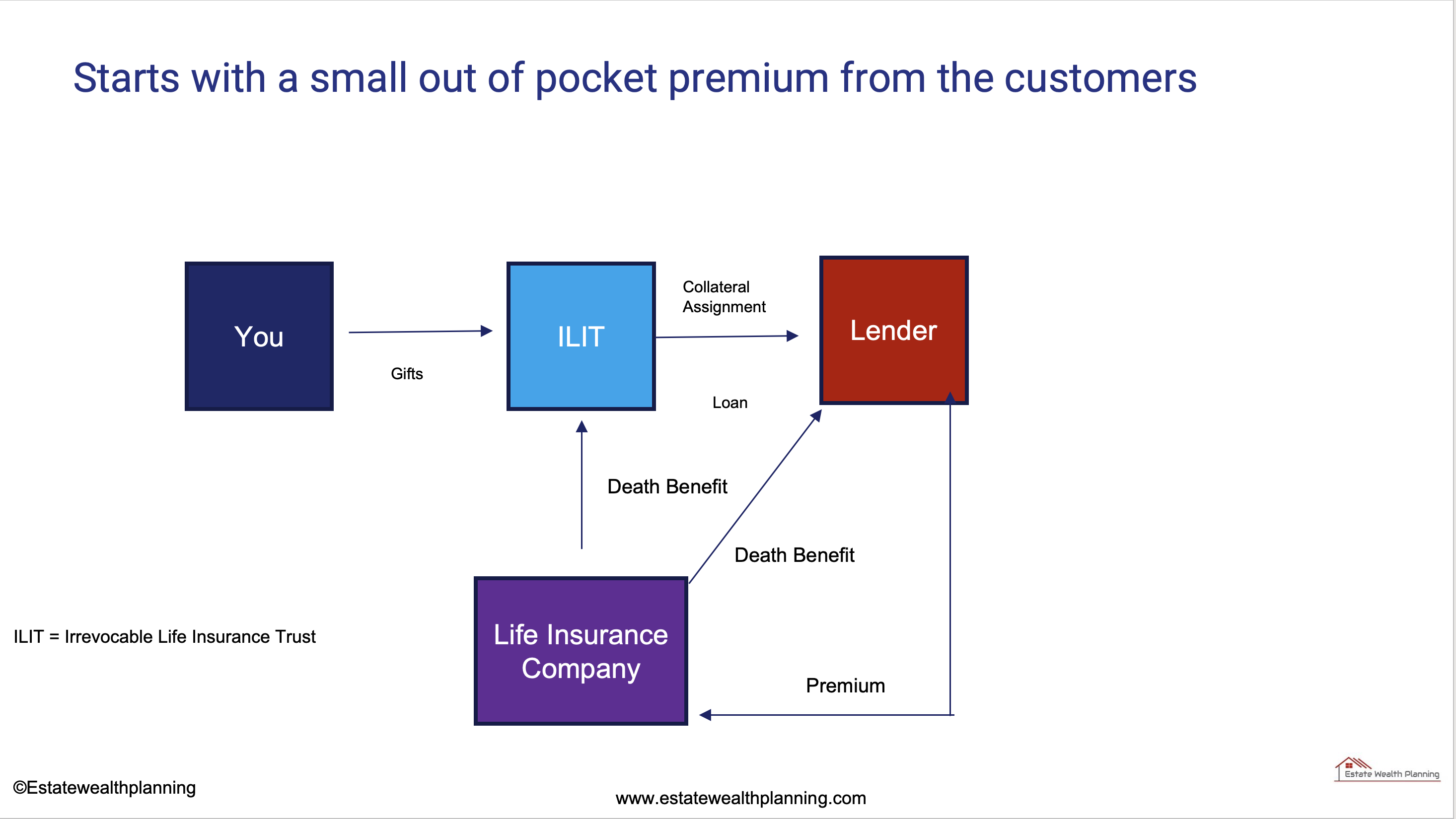

Here is how it works:

- You create ILIT, the beneficiaries of which are typically your family members

- ILIT borrows funds to pay premiums dues and collaterally assigns the policy to the lender.

- ILIT uses the loan proceeds to purchase the life insurance policy and designates ILIT as the beneficiary of the policy.

- After death, the loan is repaid from the death proceeds. Alternatively, it can be repaid during your life-time in a lumpsum money or installment from sources outside your estate.

- Death proceeds in excess of the amount required to repay the loan are distributed to the beneficiaries of the ILIT, estate and are income tax free.

- ILIT is not added to the Estate, so that you are excluding the amount from your Estate.

- When ILIT takes a loan, it is a recourse engagement, and it does not show up on the credit history.

- Insurance premier interest rates charged by the lender are much lower than real estate loans.

- These plans only participate and do not participate in a bear market as these are governed under Indexed life insurance which guarantees a payout upon death.

- These plans automatically provide long term care, critical care and internal care.

Here are some benefits of premium financing

- Multiple insurance policies can be attached to a single premium finance contract, allowing for a single payment plan to cover all insurance coverage.

- Premium financing is often transparent to the individual or company insured.

- Allows for clients to obtain needed coverage without liquidating other assets.

- The main benefit in premium financing is the avoiding the opportunity cost in paying out of pocket. By using other people's money (leveraging a lender's capital), clients can retain a significant amount of capital known as retained capital

What's in it for you?

- Protection for your beneficiaries

- Wealth transfer/ Legacy planning without any estate tax

- Peace of mind for you from the volatility of the stock market

- Smooth Transition for your loved ones

- Works for your retirement income

- Works for your kids higher education income

- It includes long term care

So what are you waiting for? Schedule a discussion with our wealth and retirement planning experts to have us help you get started.