Why use premium financing?

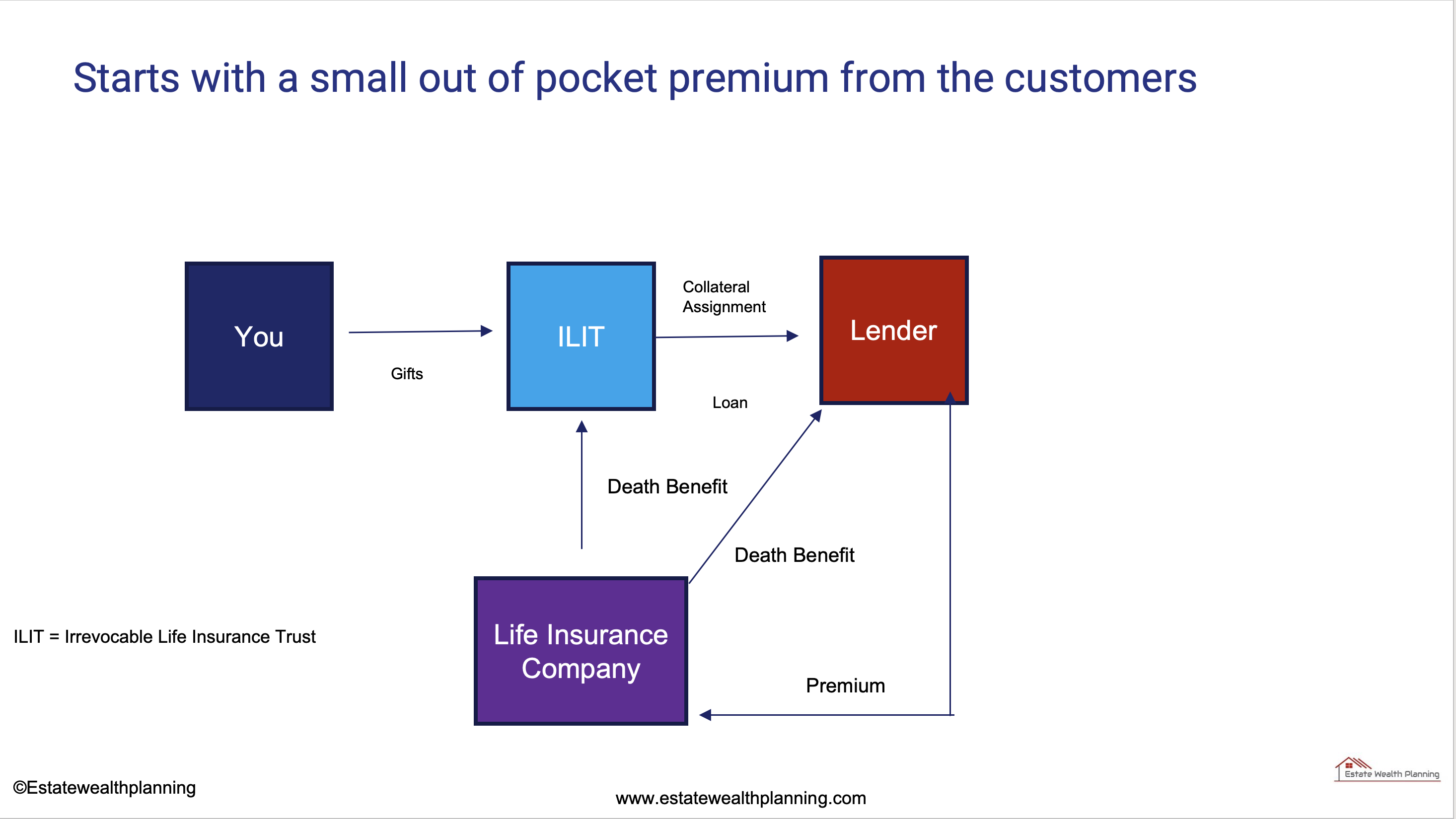

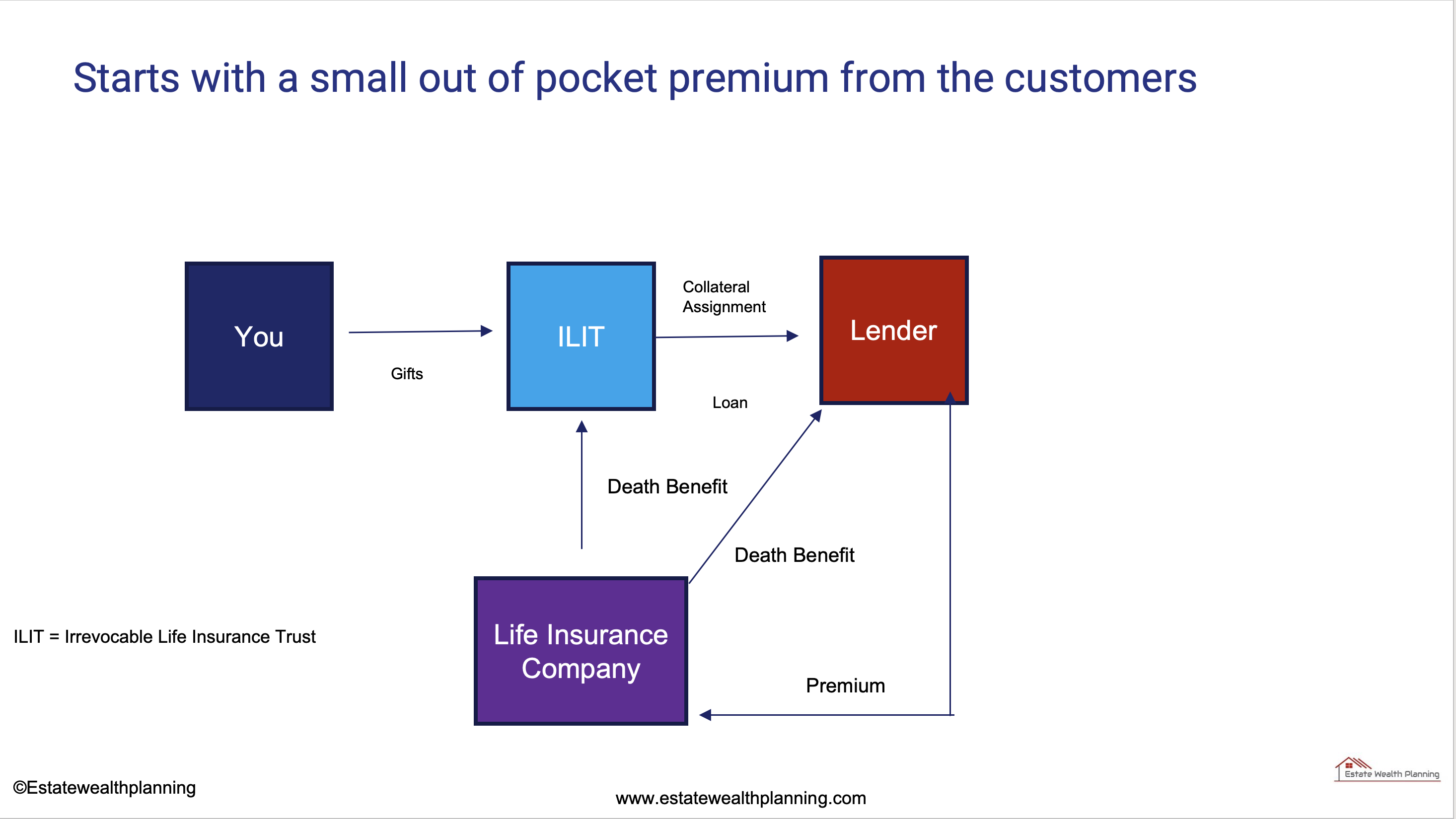

Simply put, the leverage available from premium financed life insurance allows policyowners to acquire substantially more life insurance for a small fraction of the cash flow outlay normally needed to support this big of a policy. This not only allows them to keep other assets performing elsewhere, but it often produces a very attractive tax-free IRR (internal rate of return) for a relatively nominal out of pocket cost.

The ideal plan for most premium financed life insurance strategies is that the low-interest payments to borrow these massive early premium payments creates a compounding snowball of cash value growth. If the cash value compounding overcomes the extremely low hurdle rate of the premium financing, then the policy itself can absorb the loan using the built-in policy loan feature, as well as provide the policyowner a substantial windfall. These future policy distributions can be in the form of supplemental tax-exempt retirement income, a tax-free death benefit to heirs, or both.

Who is the ideal candidate for premium financed life insurance?

Premium financing is ideal for those seeking large amounts of life insurance who are in relatively good health as well as have reputable credit.

That said, older insureds or those in substandard health may benefit substantially from certain premium financed life insurance designs since favorable leverage spreads can often make up for the higher cost of insurance. Depending on the situation, a premium financed life insurance strategy may allow older insureds or those in substandard health to acquire the proper amount of coverage they need for a fraction of the out-of-pocket cash flow cost.

However, not everyone can qualify. Premium financed life insurance is typically a strategy reserved for high net worth individuals ($5,000,000+), family trusts, or successful business entities. However, exceptions may be made for high-income earners as well as certain estate planning and/or business planning situations where the underlying insureds do not have this level of net worth.

Most premium finance clients fall into these camps:

- For wealthy families whose asset base is largely illiquid (real estate or closely held business interests), premium finance can be an ideal option to help them expand their personal estate planning without upsetting the apple cart.

- Many high net worth individuals have been using premium financed life insurance as a synthetic ROTH of sorts since actual ROTH IRAs have low contribution limits and even prohibit high-income earners from contributing. The leverage available from premium finance also offers appeal since over the last 25 years there has been a favorable spread between the low borrowing rate and the potential for cash value growth within the policies.

- For established businesses that need to maintain a strong balance sheet to acquire certain contracts, bonding, or other loans to keep their operations intact, premium financing allows them to acquire key person protection for invaluable employees or to shore up buy-sell agreements amongst the owners. More recently we are also seeing.